It’s an essential document for taxpayers in the United States who file their federal income tax returns electronically. Form 8879: IRS e-file Signature Authorization serves as the official authentication from the taxpayer to the Electronic Return Originator (ERO) to electronically transmit their tax return to the Internal Revenue Service (IRS). It also states that the taxpayer has reviewed their return, that the information provided is accurate and complete, and that they consent to the ERO submitting the return on their behalf. It is important to note that U.S. tax form 8879 does not replace the requirement for the taxpayer to sign their electronic income return; it merely serves as additional authorization for electronic transmission.

The materials available on our website, including instructions and examples, provide comprehensive assistance to help individuals navigate the complexities of the printable IRS Form 8879 and ensure that it’s accurately completed. Using the resources provided by 8879-form-printable.com allows taxpayers to save time and effort, avoiding potential errors or omissions that may lead to delays in processing their tax returns or even penalties from the revenue service. In addition, the website offers a relevant IRS Form 8879 PDF, making it easy for taxpayers to obtain the necessary sample and have it readily available for their tax preparation needs.

The IRS 8879 Form Purpose & Terms of Use

This application is required for certain taxpayers who file their income tax returns electronically. The individuals who must complete IRS Form 8879 printable for 2022 include:

- Taxpayers using a tax preparer to electronically file their annual income return and have a refund or a balance due to the IRS.

- Taxpayers who have a paid preparer file their income tax return electronically. The return contains a self-select Personal Identification Number (PIN) that the taxpayer has authorized the preparer to enter.

However, there are specific exemptions when it comes to filling and filing federal tax form 8879:

- Taxpayers who file their income declaration using self-prepared software that does not require a third-party tax preparer to submit the e-file.

- Taxpayers who consult an advisor file their income tax return via paper instead of electronically.

- Taxpayers who have already provided their signature on Form 8453, the U.S. Individual Income Tax Transmittal for an IRS e-file Return.

While Form 8879 is not directly connected to the IRS Form 1099 series, there can be an indirect connection in the context of the taxpayer's overall tax return, especially if the taxpayer has income reported on Form 1099. Here's how they might be related:

- Form 8879 is a necessary component when electronically filing your tax return. This includes the reporting of various types of income, deductions, and credits.

- If you have income reported on Form 1099 (e.g., 1099-INT for interest income, 1099-DIV for dividends, the 1099-MISC fillable form), that income needs to be accurately reported on your tax return.

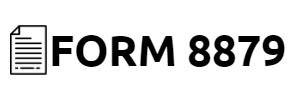

Steps to Fill Out Federal 8879 Form

Now that we have identified who must file IRS Form 8879 for electronic signature and its exemptions, let's move on to the step-by-step guide on filling in and filing the template.

- Obtain a blank sample. IRS 8879 form for 2023 printable can be accessed and downloaded from any trustworthy website. To ensure accuracy, always download the latest version of the sample.

- At the top of the document, provide the taxpayer's name, social security number, and address. Additionally, if filing a joint return, include the spouse's name and social security number.

- In Part I, enter the "EIN, Form Number, and Ending Period (MMYY)" for filing the return. If more than one return is being filed, use separate Forms 8879 for each return.

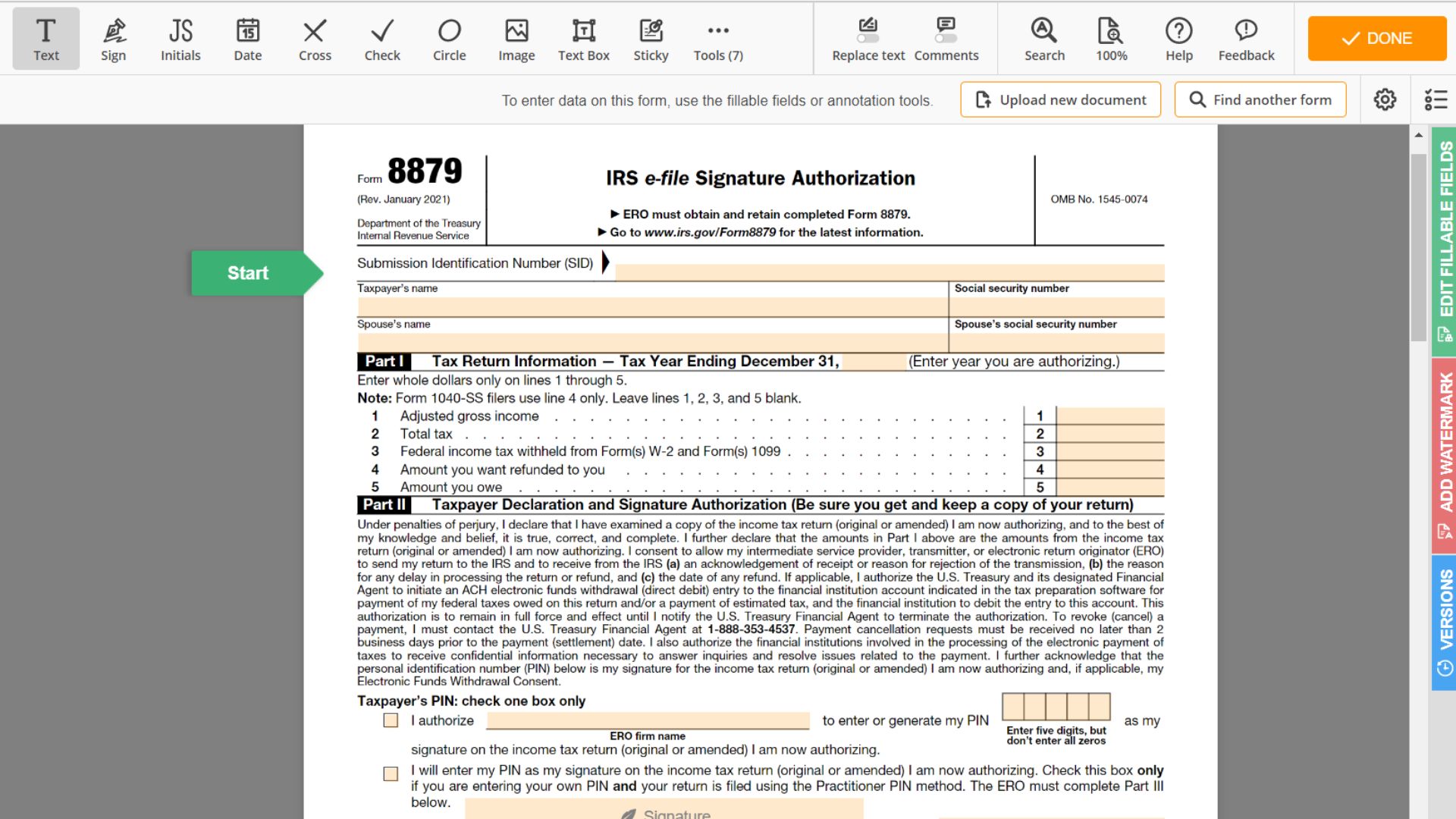

- In Part II, the advisor must provide their Preparer Tax Identification Number (PTIN) and their firm's EIN, if applicable.

- Before signing the printable federal 8879 form, reviewing and understanding the declaration statement is crucial. The taxpayer is ultimately responsible for the accuracy and completeness of their income tax return.

- Both the taxpayer and the advisor must sign and date the copy. The spouse must also sign and date the sample when filing a joint return.

- The completed 8879 sample should be retained by the consultant and not submitted to the IRS. The form should be kept on file for three years from the return due date or the date the return was filed electronically, whichever is later.

In conclusion, understanding the purpose and process of filing IRS Form 8879 printable is essential for those required to submit it. By following the steps outlined above, taxpayers and tax preparers can ensure they correctly complete and retain the 8879 form, leading to a smoother and more efficient taxation process.

Extra Instructions for 8879 Tax Form for 2023

- What is IRS Form 8879 and when must I use it?

It is used when filing your taxes through an Electronic Return Originator (ERO) or a tax professional submitting your return on your behalf. The 8879 form authorizes the ERO to submit your return electronically to the IRS. You should complete the printable blank 8879 form for 2022 after your declaration has been prepared and you have reviewed it for accuracy. - Where can I find IRS Form 8879 instructions and a blank template for 2022?

IRS Form 8879 for download is available online. Search for it on the IRS website, and choose the appropriate tax year. You can also obtain the template and its instructions from your tax professional or an authorized e-file provider. - Can you provide a sample of the 8879 form to help me understand the required information?

A relevant example can be found on the IRS website, showing the sections and required information. The form includes sections for your name, Social Security number, the tax year, and signature. If you file a joint return, your spouse's information will also be required. - How can I download a printable tax form 8879 for my records?

To download the sample, visit the IRS website and search for "Form 8879." Once you find the template for the appropriate year, click the "Download" button to save an 8879 copy to your computer. You can then open the file and print it for your records. - What should I do if I notice an error on my tax return after signing IRS Form 8879?

You should contact your advisor or ERO immediately to discuss the issue. They can help you determine whether an amended return is necessary and guide you through the process of correcting the error.

Easy E-Sign for IRS Form 8879

Easy E-Sign for IRS Form 8879

Printable IRS Form 8879

Printable IRS Form 8879

2023 Fedral Form 8879

2023 Fedral Form 8879

8879 Tax Form - Instruction for 2023

8879 Tax Form - Instruction for 2023

Printable IRS Form 8879 Guide

Printable IRS Form 8879 Guide